Sheikh Maktoum Bin Mohammed Bin Rashid Al Maktoum, Deputy Ruler of Dubai, Tuesday announced the launch of the region’s first ‘Virtual Company Licence’.

The Virtual Company Licence will allow investors worldwide to do business in Dubai digitally without requiring residence and in accordance with the highest international legal standards. Virtual Company Licence owners can manage all their business-related activities, including document signing and submission digitally, and the signatures are legally binding in the UAE.

This initiative is aligned with the third Article of the 50-Year Charter of His Highness Sheikh Mohammed Bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, which aims to build a ‘Virtual Commercial City’ in Dubai.

Sheikh Maktoum Bin Mohammed said that Dubai is making major strides in enhancing business regulatory frameworks and emerging as one of the world’s best business environments, thanks to the vision of His Highness Sheikh Mohammed Bin Rashid Al Maktoum and the directives of His Highness Sheikh Hamdan Bin Mohammed Bin Rashid Al Maktoum, Crown Prince of Dubai and Chairman of The Executive Council. Dubai’s leadership has taken a number of innovative decisions and initiatives to further cement Dubai’s position as one of the world’s major business hubs.

Who is the licence for?

The Virtual Company Licence, a joint initiative of Dubai Economy, Dubai International Financial Centre (DIFC), General Directorate of Residency and Foreigners’ Affairs (GDRFA), Smart Dubai, and the Supreme Legislation Committee, focuses on three main sectors: creative industries, technology and services.

The initiative, which offers vast opportunities for investors around the world to work digitally in Dubai without having to be in Dubai, will enhance confidence among businesses and investors while also opening new horizons for business competitiveness and growth in Dubai and the UAE.

Verified non-residents and freelancers

The programme allows only verified non-resident individuals to register a company, and the owners of such companies have to be the nationals or tax residents of countries that have implemented the Convention on Mutual Administrative Assistance in Tax Matters and share tax information about their citizens and residents.

The Virtual Company Licence will also enable freelancers and business people worldwide to have access to a regulated e-commerce platform and easily work with Dubai-based companies while also exploring new markets and investment opportunities digitally.

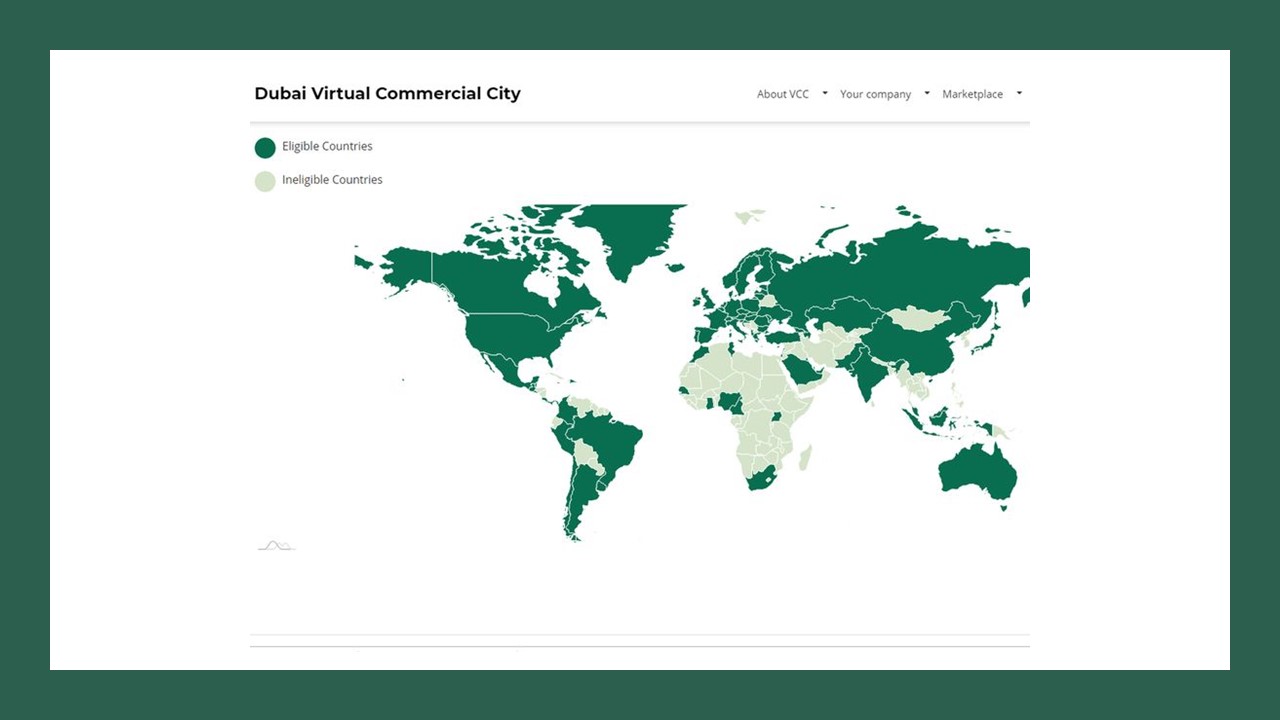

Eligible countries

The official website has a heatmap showing the eligible and non-eligible countries across the globe. India, Pakistan, Saudi Arabia, China, Russia, North Americas, South Africa, Nigeria, Cameroon, Uganda, Brazil, Argentina, Chile are some of the countries on the eligible list. Yemen, Oman, Sri Lanka, Thailand, Venezuela, Algeria, Egypt are on the non-eligible list according to the map online.

Source: https://gulfnews.com/business/dubai-virtual-company-licence-for-non-resident-business-people-and-freelancers-1.1569863099064

Contributed by Kristine Madugay of MENA Management Consulting for Oryx World Business Centre News and Insights.